reit dividend tax malaysia

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. A REIT in Malaysia operates by pooling the.

Pdf Stability Of Dividends And Ffos The Case Of Reits In Malaysia

In Malaysia there are mainly 5 types of REITs.

. REITs are a type of. Axis REIT Annualised return. HEKTAR REAL ESTATE INVESTMENT TRUST.

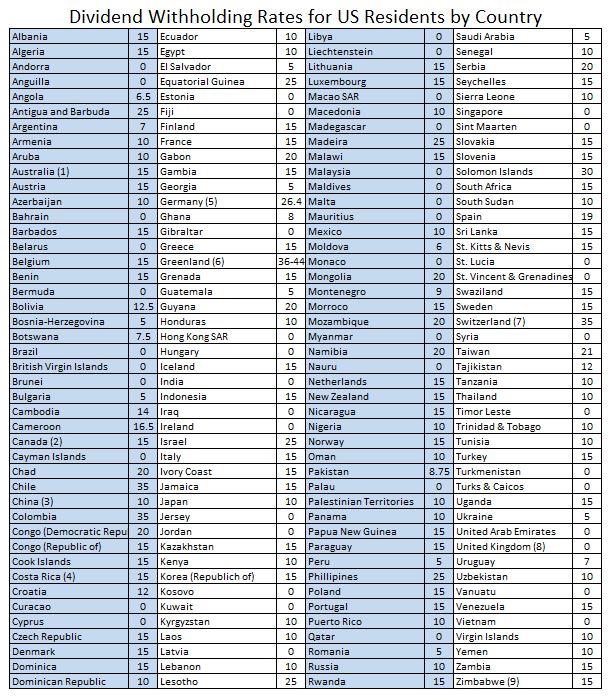

You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs. 20 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link. As a comparison neighbouring.

Including the dividends every RM1000 would. 655 Coming Quarter Report. A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at.

I would not buy this 5 reits now because the Dividend Yield DY are the lowest as well from 469 to 524 before deducting. Retail REITs shopping malls. Perhaps the most notable form of tax-free dividend from companies is from Real Estate Investment Trusts REITs or Property Trust Funds PTFs.

It may also earn income from fixed deposits or selling its real estate investments. When Malaysians invest in the US the dividends. Simply put the rental income received by the.

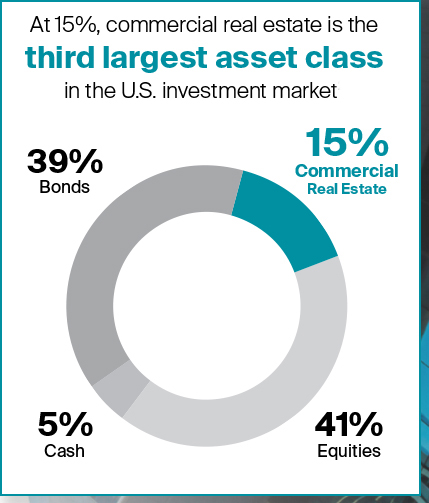

IGB Commercial REIT was listed in September 2021. Since it was first introduced in Malaysia in 1989 REITs have allowed small-time investors to acquire and own a small portion of an otherwise expensive piece of real estate. Trusts or Property Trusts REITPTF in Malaysia.

Prior to the announcement under the tax laws a property trust fund essentially an unit trust with income. Real estate investment trusts REITs are a unique form of investment designed to make money for you through the property industry. REITs in Malaysia do not have to pay income tax if they distribute at least 90 of their current-year taxable income.

Under Section 61A1 of the. Hence you do not need to pay taxes on the. 1074 Since 2005 every RM1000 investment in Axis REIT wouldve turned into RM2980.

As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption. Yahoo Google Bursa Web TradingView. Here we have highlighted the Top 10 REITs in Malaysia by market cap.

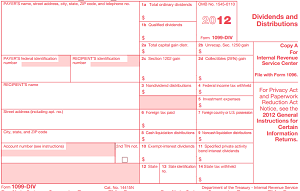

21 rows Malaysian REIT Data LIVE Daily Updates. Its DPU shown in table was an annualised figure for the period between. Dividend withholding tax is how a country taxes the non-residents who have derived dividend income from the country.

Dividend income forms part. Axis REIT Annualised return. AL-AQAR HEALTHCARE REIT Last Price.

Not all dividend payments are equal. Is REIT Dividend Taxable In Malaysia. 119 TTM Dividend Yield.

Reits As A Less Stressful Option

Finance Malaysia Blogspot Understanding Reits

Why Invest In Reits Benefits Of Reit Investing Nareit

Emergence Of Real Estate Investment Trust Reit In The Middle East

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table

Understanding The Reit Taxation Rules Novel Investor

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

Pdf Comparison Of Reit Dividend Performance In Nigeria And Malaysia

Things To Consider Before Investing In Foreign Dividend Stocks Seeking Alpha

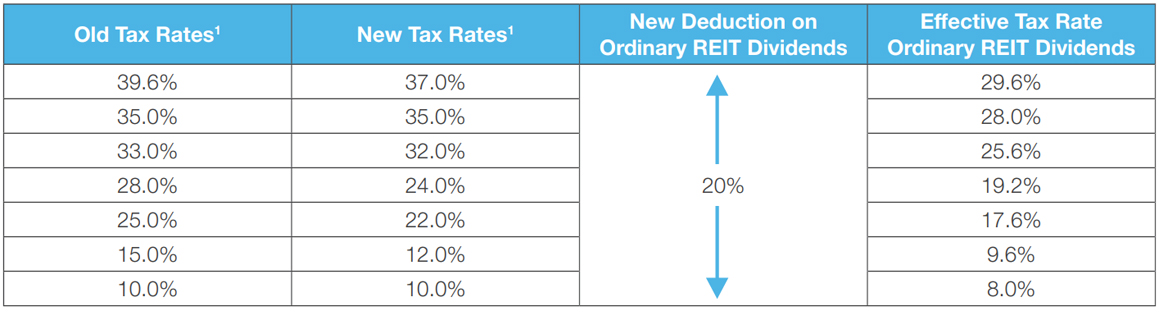

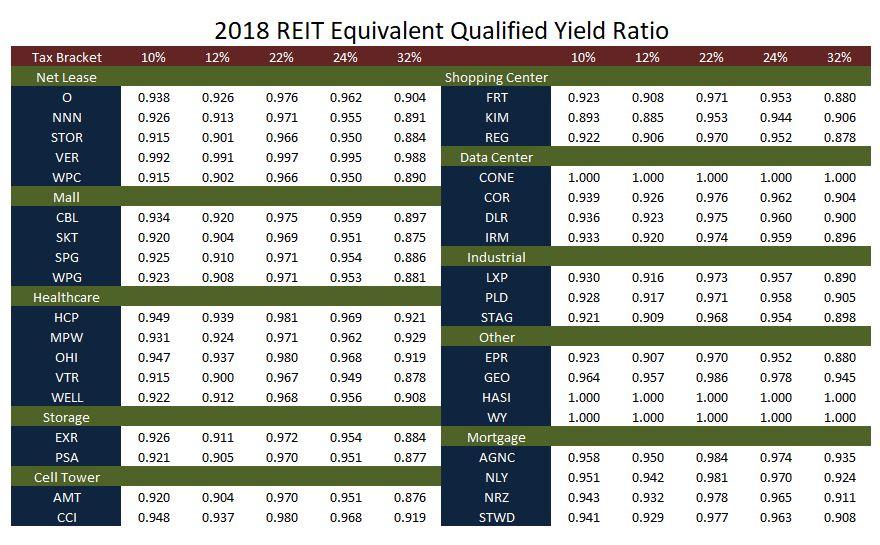

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Reits Rise In Asia Blogs Televisory

How To Invest In Reits In Malaysia And Why Is It An Alternative To Property Investment Iproperty Com My

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

How Tax Efficient Are Your Reits Seeking Alpha

Four Differences Between Real Estate Syndications And Real Estate Investment Trusts